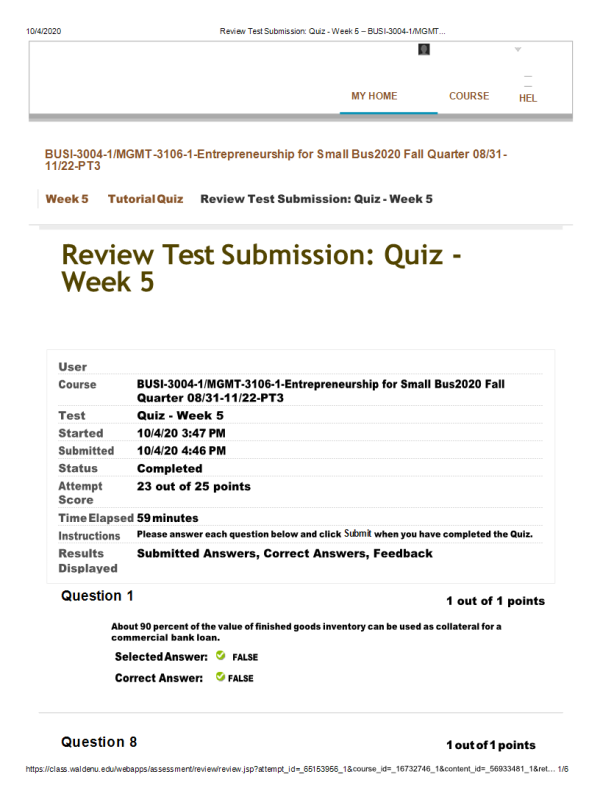

BUSI 3004 Week 5 Quiz

- $25.00

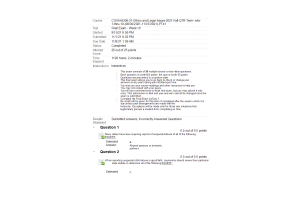

- Question: About 90 percent of the value of finished goods inventory can be used as collateral for a commercial bank loan.

- Question: ….. financing does not require any collateral.

- Question: In a factoring arrangement, the factor:

- Question: Typically, debt financing requires:

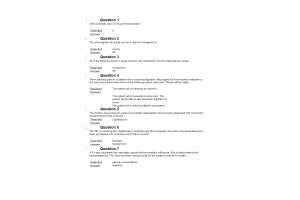

- Question: The U.S. Department of Justice frequently issues guidelines for di"erent types of mergers..

- Question: The least liquid current asset, is eliminated when calculating the acid test ratio.

- Question: Which of the following is not an advantage of franchising?

- Question: Venture capital firms generally prefer a minimum funding level of $100,000.

- Question: Which of the terms in a franchise agreement is the most likely cause of a lawsuit?

- Question: In a private venture capital firm, the manages the fund in exchange for a management fee and a percentage of profits.

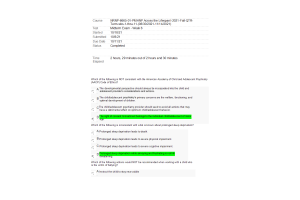

- Question: Under the Small Business Technology transfer (STTR) program, federal agencies with budgets over $1 billion are required to set aside 0.3 percent for small businesses.

- Question: In an R&D limited partnership the liability for losses incurred is borne by the limited partners.

- Question: The informal risk-capital market is made up of .

- Question: Franchising means that the franchisor is no longer able to benefit from economies of scale in purchasing.

- Question: In most leveraged buyouts, the equity usually exceeds the debt capital equity by 5:1.

- Question: Trust receipts are inventory loans used to finance floor plans of retailers such as automobile dealers..

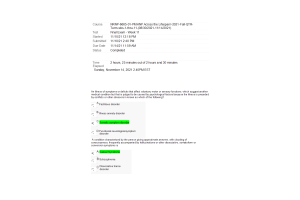

- Question: With the enactment of the Sarbanes-Oxley Act in 2002, the expense and administrative responsibilities of being a public company, as well as the liability risks of officers and directors, are significantly lesser..

- Question: For the franchisor, the capital required to expand a venture quickly is less than it would be without franchising.

- Question: The most common type of joint venture is between two or more private sector companies.

- Question: Making long-term decisions can be difficult in publicly traded companies where sales and profit evaluations indicate the capability of management via stock values.

- Question: The personal funds of the entrepreneur are the least expensive in terms of cost and control.

- Question: The costs of establishing R&D limited partnerships are greater than conventional financing.

- Question: The asset base for loans is usually accounts receivable, inventory, equipment, and real estate.

- Question: The underwriter is of critical importance in establishing the initial price for the stock of the company.

- Question: The most frequently used source of short-term funds when collateral is available is: