FNCE 3001-1, MGMT 3004-1, Financial Management Week 3 Midterm (100% Correct Fall Quarter)

- $25.00

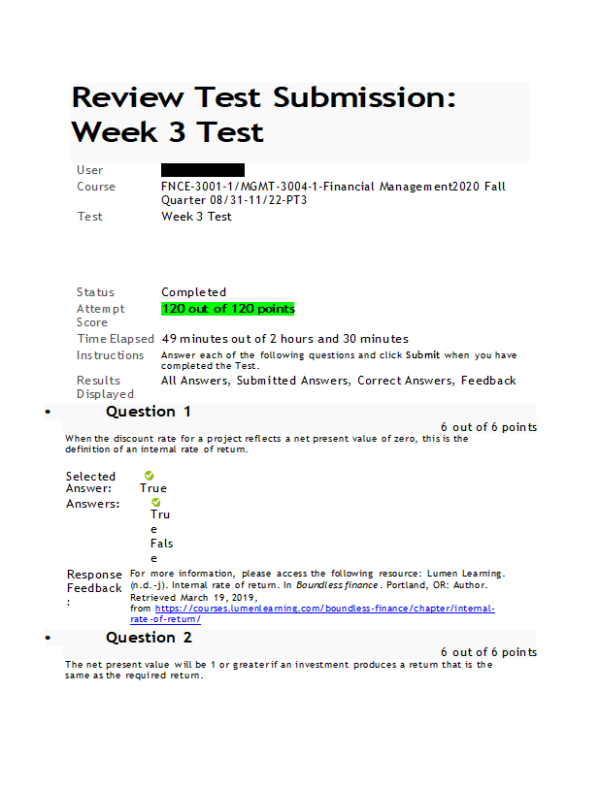

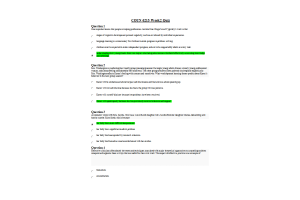

1.Question: When the discount rate for a project reflects a net present value of zero, this is the

definition of an internal rate of return.

2.Question: The net present value will be 1 or greater if an investment produces a return that is the

same as the required return.

3.Question: When monthly interest is expressed as only being compounded annually, this is known as the annual percentage rate.

4.Question: What is the future value of $6,500 invested for 7 years at 10% compounded annually?

5.Question: The Net Present Value:

6.Question: If an inheritance is compounded annually at 11% and reaches a total of $100,000 after 21 years, what would the starting amount of the investment be?

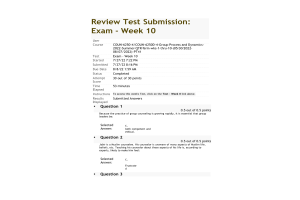

7.Question: An investor should reject a project if the profitability index has a value greater than 1.

8.Question: If you were to analyze a project using the payback method, which of the following aspects would you purposely disregard?

9.Question: How many years does it take to save $4,341 if you start with $810 and earn a 9% annual interest rate?

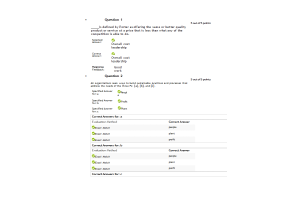

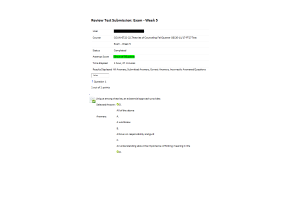

10.Question: Kirsten and Tanner will celebrate their 30th wedding anniversary in a few years, and their four children want to surprise them with a cruise. The children prefer to save the money together and then purchase the tickets in 3 years. The children will be able to earn 6% interest on their investment. At the end of the first year, the oldest child will contribute $1,000. The two middle children will contribute $1,600 at the end of the second year. At the end of the third year, the youngest child will contribute $600. When the siblings purchase the tickets at the end of the third year, how much money will they be able to spend on the cruise?

11.Question: If Barbara increases the monthly payment amount by $200 for her mortgage, which is on a 30-year payment plan, this decreases the present value of the annuity.

12.Question: You deposit $3,325 in a bank account that pays 3% simple interest. How much interest will

you earn over the next 7 years?

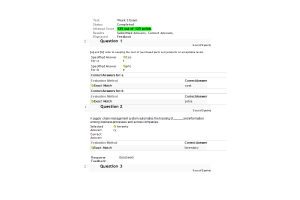

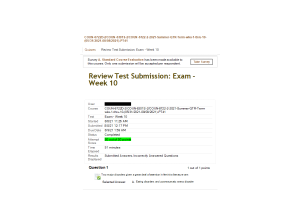

13.Question: The value that is created from the investment of each dollar is known as the profitability index.

14.Question: A/An is calculated by multiplying the monthly interest rate by 12.

15.Question: You have a present value of $432, future value of $896, and 10 years as the number of periods. What is the interest rate?

16.Question: When a trust fund is established to provide annual scholarships indefinitely, which of the following is the best way to describe the scholarships?

17.Question: Internal rate of return is the type of capital budgeting method considered to be the superior method when analyzing a project or investment.

18.Question: Kathy is purchasing a car and plans to finance it. She decides to take out a 5-year loan, which will mean her monthly payments are $655. Which of the following terms can be used to describe her car payments?

19.Question: Medical bills are an example of an annuity.

20.Question: Payments for an annuity due are recurring and are paid at the end of a period.